In Dec. 2015, facing huge

inventory of temporarily-stored corn and unsalable corn in many places, Chinese

government is expected to re-implement the subsidy policy on corn

transportation. CCM believes this will change the supply pattern of the corn

industry and offer northeast corn more obvious cost advantage.

In Dec. 2015, corn is unsalable

in many places of China due to the new peak of corn output. Meanwhile, the

inventory of temporarily-stored corn is also very high in China. Therefore, the

discuss on whether Chinese government should re-implement the subsidy policy on

corn transportation to consume the inventory and to boost the activity of

sending grains from the North to the South becomes a hotspot nowadays. Data

from the China National Grain & Oil Information Center (CNGOIA) show that

the corn output will hit a record high in 2014/2015, being 219 million tonnes,

up 2.41% year on year. As of 1 Dec., China’s corn inventory has reached 180

million tonnes.

The subsidy policy on corn

transportation means that the government will provide a one-time subsidy for

those feed enterprises in southern feed consuming provinces that transport corn

from Heilongjiang Province, Jilin Province, Liaoning Province and Inner

Mongolia Autonomous Region for sales, processing or storing.

Since China has implemented

temporary purchase and storage policy for 8 years, Chinese government has

offered southern feed enterprises twice subsidies on corn transportation.

In 2009/2010, the subsidy was

USD10.95/t (RMB70/t). At that time, China’s corn deep-processing and feed

industries embraced rapid development. Meantime, Northeast China suffered from

droughts, which reduced the corn output. Sourced from the CNGOIC, the corn

output was 164 million tonnes, down 7%-9% compared to the last year. The market

presented a situation where supply fell short of demand. In order to promote

the fair competition of feed enterprises in the South and the North, Chinese

government carried out subsidy policy.

In 2013/2014, the subsidy was

USD21.90/t (RMB140/t). Affected by the serious bird flu took place in China in

April 2013, the poultry farming industry was in downturn, suppressing the

demand for downstream feed products. At that time, the inventory of

temporarily-stored corn was about 75 million tonnes. To stimulate the operating

rate of enterprises, Chinese government formulated the subsidy policy.

According to analyst CCM, it is

very likely for China to implement subsidy policy for corn transportation again

in the future.

Firstly, regarding the current

inventory, the corn inventory has reached 180 million tonnes in China, as of 1

Dec. The figure is 2.4 times that in 2013/2014. The government faces

unprecedented pressure on inventory.

Secondly, Chinese government is

under the pressure of public opinion of policy fault since corn is found

unsalable in many places. How to stimulate the production of downstream

enterprises quickly and effectively to consume the corn becomes the urgent

affair.

Thirdly, since Jilin Province

(Northeast China) enjoys the processing subsidy of USD54.71/t (RMB350/t), it is

of obvious cost advantage. In order to ensure the fair competition, it is

reasonable to subsidize southern enterprise on transporting corn.

In the cast of the supply,

southern feed enterprises should have been inclined to purchase northeast corn

because Northeast China has large corn planting areas for them to select.

However, the long transport distance results in high transportation cost.

Besides, the northern corn price was significantly declined in Oct. 2015. At

the end of Oct., the purchase price of northern corn was USD257.92/t

(RMB1,650/t), down 6.89% compared to the early of Oct. And the average price of

northeast corn was USD289.18/t (RMB1,850/t) in Oct., which was obviously higher

than that of northern corn. Thus feed enterprises are more willing to purchase

northern corn (For more details, please refer to the Northern corn squeezing

northeast corn market in China in the Corn Products China News 1510).

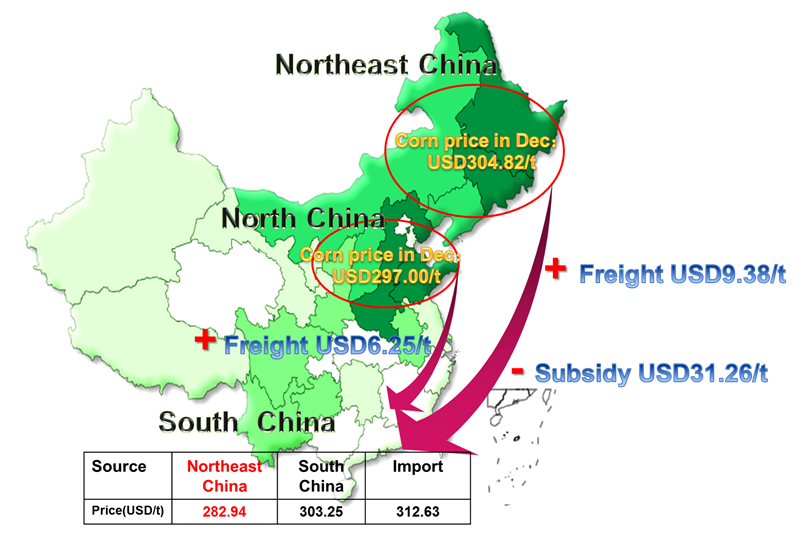

Currently, it is generally

predicted that the transportation subsidy would be about USD31.26/t (RMB200/t)

in 2015. If the subsidy policy is implemented, it can reduce the purchase cost

of southern feed enterprises and will change the supply pattern of corn,

offering northeast corn more obvious cost advantage.

Comparison of cost advantages of Northeast

corn and Northern corn after implementation of transport subsidy

Note: The transportation cost is calculated based on shipping.

Source: CCM

About CCM:

CCM is the leading

market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to

industry newsletters and customized market research reports. Our clients

include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of

Kcomber Inc. More about CCM, please visit www.cnchemicals.com.

We will attend FIC in the coming week. If you would like to meet us for consultancy in FIC, please get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.